Former CIA station chief in Moscow Dan Hoffman discusses the Biden administration sending additional aid to Ukraine following the Trump victory, President-elect Trump’s strategy for the conflict, as well as his foreign policy for the Middle East.

FIRST ON FOX: Michael Lucci, CEO of State Armor – a global security watchdog group – issued a cautionary letter to governors and state fiscal leaders, urging them to reconsider investments in China-based companies due to heightened geopolitical risks and the likelihood of increased U.S. restrictions.

« In addition, the Chinese Communist Party’s (CCP’s) extensive control over companies prevents fiduciaries from accurately assessing China-based investments, » Lucci wrote. « Indeed, the CCP has taken steps to prohibit accurate audits, and prevent firms from conducting due diligence. The CCP has repeatedly interfered with its stock and bond markets, and places CCP and militia cells within companies. »

DRONEMAKER DJI SUES PENTAGON OVER CHINESE MILITARY LISTING, ALLEGES SIGNIFICANT FINANCIAL HARM

The flags of the United States and China fly from a lamppost in the Chinatown neighborhood of Boston on Nov. 1, 2021. (Reuters/Brian Snyder/File Photo / Reuters Photos)

Lucci noted that many states lost pension fund value due to similar oversight with Russian investments before the Ukraine conflict. As tensions rise over Taiwan and the U.S. imposes tighter controls on Chinese financial interests, Lucci advised that states re-evaluate their fiduciary duty to pensioners, suggesting divestment from China-based companies as a proactive measure to protect state assets.

In a statement to FOX Business, Lucci said in part, « State and local pensions lost billions on Russian investments after Russia’s invasion of Ukraine. »

« Since then, they have made the tremendous mistake of pouring tens of billions of taxpayer dollars into China even as China threatens to invade Taiwan, » Lucci said. « There is no reason to have any public funds invested in China, and the argument to divest is backed on the strongest grounds of fiduciary duty, national security, and human rights. »

The letter comes as China-hawk Sen. Marco Rubio, R-Fla., has been tapped to be President-elect Donald Trump’s secretary of state. Rubio’s appointment still needs to be confirmed by the Senate.

CHINA EXPERT SOUNDS ALARM OVER ‘WAR SIGNALS’: ‘XI JINPING IS ABOUT TO DO SOMETHING TRULY HORRENDOUS’

Investors are paying attention to the stock market at a securities business hall in Fuyang, China, on Dec. 5, 2023. (Photo by Costfoto/NurPhoto via Getty Images)

Earlier this month, more than a dozen financial officers from 15 states also sent a letter to public pension fund fiduciaries, urging them to cut ties with China-based investments due to the CCP’s control over some firms.

The bipartisan House Select Committee on the Strategic Competition between the U.S. and the CCP released a report earlier this year detailing how asset managers and index providers facilitated investment of more than $6.5 billion to 63 companies in China that have been blacklisted or red-flagged by the U.S. government.

Under current law, U.S. government agencies maintain a variety of blacklists and red-flag lists that serve a range of purposes, from barring exports to covered foreign firms and blocking imports due to connections with the use of forced labor, to restricting purchases of equipment that poses a national security risk and more.

US COMPANIES WITH HIGH CHINA EXPOSURE FACE MORE RISKS

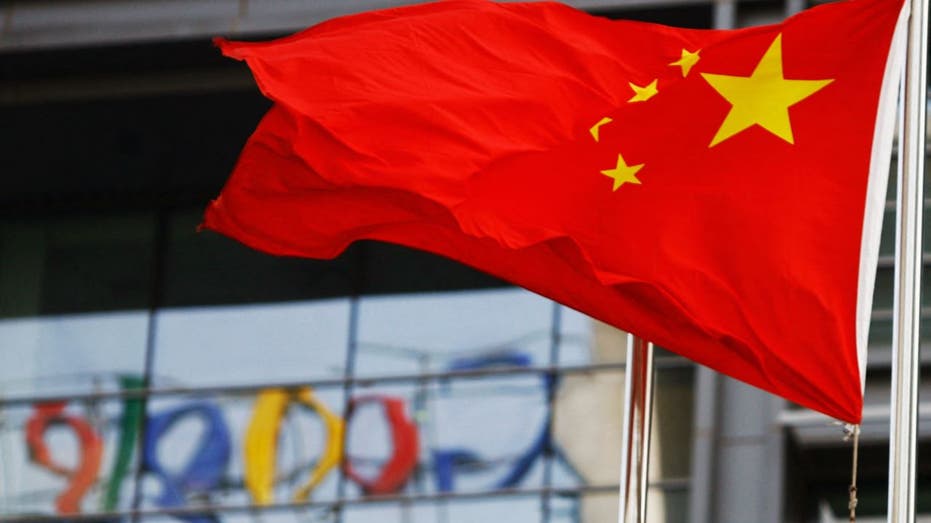

A watchdog letter is urging U.S. state leaders to divest public funds from China, citing rising risks of geopolitical conflict, lack of financial transparency and U.S. restrictions. (Photo by LI XIN/AFP via Getty Images / Getty Images)

Most of these lists do not restrict U.S. asset managers or investors from investing in listed companies. One list that does restrict U.S. investment in listed firms, the Treasury Department’s NS-CMIC list, blocks investment only in listed firms but excludes those companies’ subsidiaries, allowing them to receive U.S. capital.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Fox Business Network’s Eric Revell contributed to this report.