Martin Lewis is urging people who earn £80,000 or less who claim Child Benefit to call up HMRC and get a new tax code.

That’s because HMRC has changed the rules on the way it allows people to claim the benefit – and it’s a time saver if you earn £80,000 or less.

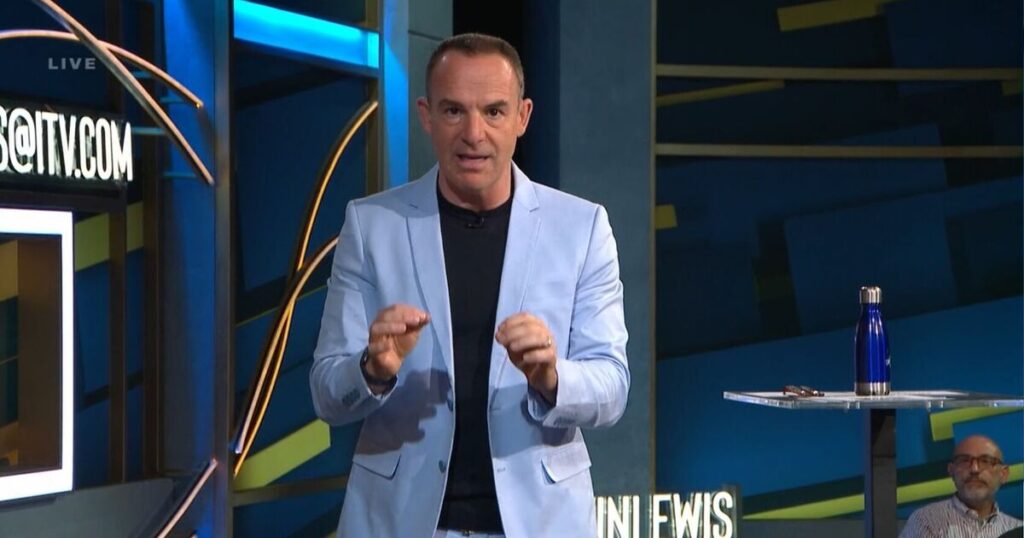

Returning this week on the latest episode of The Martin Lewis Money Show Live on ITV1 and ITVX, Martin explained how to make best use of a new HMRC rule around Child Benefit and Income Tax.

Child Benefit is available to anyone who has at least one child aged under 18 living at home with them. It pays £26.05 per week, or £1,354.60 per year, for the first child and an additional £17.25 for each child thereafter.

There is no cap on how many children you can claim Child Benefit for, other than the overall Benefits Cap, and confusingly, this is not the same as the two-child benefit cap, which is about Universal Credit.

But you start to lose your Child Benefit payments once you earn £60,000 or more. For every £1 you earn above that amount, HMRC asks you to give back some of the benefit via tax, up to £80,000 and above, at which point you have to repay all of the benefit.

But to do this, you used to have to fill in a self-assessment tax return via HMRC, which takes time and effort, and now those who only need to fill in this form for the purposes of the High Income Child Benefit Charge no longer need to do so, Martin explained.

He said: “There are many people out there with Child Benefit who are on the Higher Income Child Benefit Charge.

“It’s still worth getting it with an income under £80,000, the big problem is administratively you had to fill in a self-assessment tax form.

“If you wouldn’t otherwise be doing self-assessment, they’ve now put a new system in. That means call HMRC and you arrange to pay by your tax code.

“That’s the code that lets your employer know how much tax to take from what you earn. So [you] pay a little bit more tax from your employer. [It] won’t save you any money but it will save you the administrative burden of doing self-assessment. But it’s only for those people who wouldn’t be doing self-assessment otherwise.”

HMRC explains how the charge works: “To work out if your income is over the threshold, you’ll need to work out your ‘adjusted net income’.

“Your adjusted net income is your total taxable income before any allowances and not including things like Gift Aid. Your total taxable income includes interest from savings and dividends.

“You may have to pay the High Income Child Benefit Charge if you or your partner have an individual income that’s over the threshold and either: you or your partner get Child Benefit; someone else gets Child Benefit for a child living with you and they contribute at least an equal amount towards the child’s upkeep. It does not matter if the child living with you is not your own child.”

The Martin Lewis Money Show Live September 30 episode is still available to watch via ITVX.