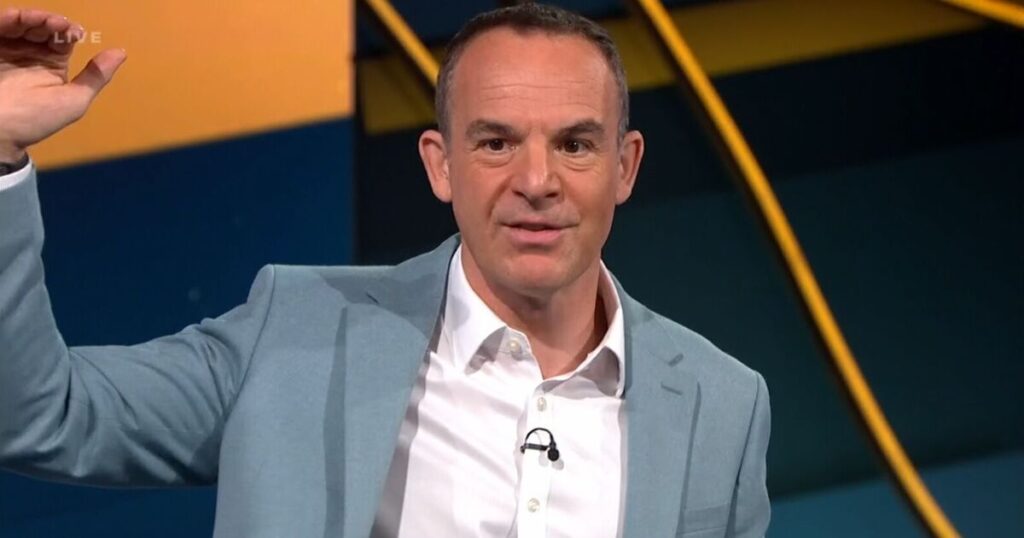

Money expert Martin Lewis has explained why high interest regular savings accounts don’t actually pay as much interest as you think they would.

Money Saving Expert founder Martin Lewis says ‘lots of people’ get in touch with him to point out that regular savings accounts are a ‘con’ because of a rule about the way the interest in the accounts is calculated. Many bank accounts offer customers a high-interest regular savings account which pay as much as 7% interest to those saving every month, usually with a cap on how much you can deposit each month.

But you won’t actually get as much interest as you might think, Martin warned, because the interest is only paid on what you put in as you go, and you won’t max out the account until the end of the year.

Speaking on the latest episode of The Martin Lewis Podcast on BBC Sounds and Spotify, Martin explained: “Lots of people get in touch with me about these regular savings accounts and go ‘it’s a con! It’s a con!’.

“This is the reason why they say that: let’s say it pays 7% interest and you put in £300ish a month. At the end of the year you’ve got £3,000 in the account and they go ‘I’ve got £3,000 in the account, it’s 7% interest, I should be getting £210 interest.

“And they look in the account and they have a total of £110 interest and they go ‘it’s a con! It’s a con!’.

“What’s actually happening is you only get paid interest on the amount that you have in the account. Now if you think about it you’re putting in roughly £300 a month, well you only have £3,000 in for the very last day, the month before you had £2,700 in, six months before you had £1,400-£1,500 in.

“So actually the way to think about it is I’m going to get roughly half the interest I think I would because while I’ve got £3,000 in at the end of the year, my average balance over the year is about half that, so I’m going to get roughly 7% of £1,500.

“But the crucial thing is, on the money that is in there, you’re still getting the best interest possible.

“So don’t not use a regular saver because of that maths. You’re still getting the most interest on whatever money you had in that account.”