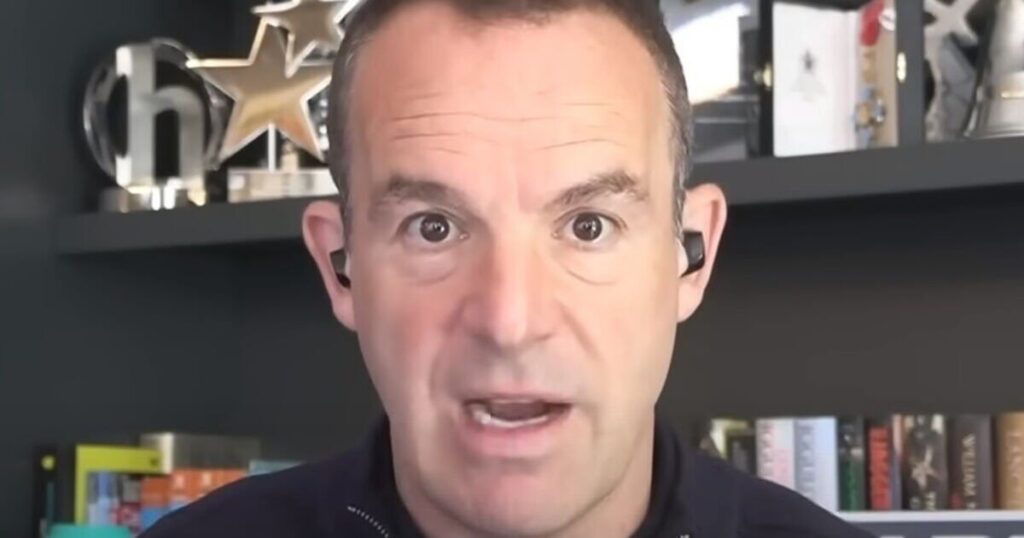

Martin Lewis has pointed to a top-paying 5.5% interest savings account that may suit those soon to retire.

The financial expert said on his BBC podcast: « For Nationwide customers, you may be able to get unbeatable 5.5 percent fixed savings.

« If you were a customer on 22 May, Nationwide is offering you that 5.5 percent fix for 18 months. Minimum £1, maximum £10,000, you get the interest at maturity. »

The account he was referring to is the Member Exclusive Online Bond, which can be opened and managed online.

To be eligible, you have to have been a Nationwide member on May 22. This includes those who had a savings account, a current account or a mortgage with the group on this date.

Mr Lewis went on to explain how knowing when you will get the interest paid can be a help for those soon to retire.

He expained: « The interest crystalises for tax purposes when you can access it.

« So if you’re getting a fixed account and you don’t want the interest this year, because you’re earning more this year – let’s say you’re retiring this year – then by fixing an account, and making sure the interest is only paid next year, and you can only access it next year, you can move the interest into the next tax year.

« Therefore that might be beneficial to you. »

The founder of MoneySavingExpert also recently helped a pensioner to understand how savings allowances affect him, in another recent podcast episode.

He had a call from a man wanting to know how the £5,000 starting rate for savings works, which allows a person on an income below the £12,570 personal allowance to earn £5,000 in savings interest tax-free.

He asked: « I’m in a situation where I’ve been lucky enough to retire a couple of years before retirement age.

« I’ve got a relatively low income for a few years until my state pension kicks in or I take some money out of my private pension plan but I’ve got relatively high savings. »

Mr Lewis told the man he was fortunately in a « sweet spot for the starting savings rates ».

He expained: « This is for anyone with relatively low income and high interest effectively. You may be able to get up to £18,570 without paying any tax on it. »

He went on to explain the « right circumstances » for this would be if a person had an earned income, not savings income, under the allowance of £17,570.

Individuals in this situation can combine their £12,570 personal allowance with the start rate of £5,000 to earn £18,570 tax-free

Mr Lewis has also issued a warning to savers looking to switch that they may need to act soon to get £175 when switching to either Lloyds or First Direct.

He warned in the latest edition of the MoneySavingExpert newsletter: « They’re not saying they’re due to end imminently, but closing dates can and do change quickly. »

Lloyds Bank is offering £175 in cash to to those who switch to a Club Lloyds account, which has a £3 monthly fee, which is waived for each month you deposit £2,000 or more.

First Direct is also offering switchers £175 as an incentive when opening a 1st Account current account.

For the latest personal finance news, follow us on Twitter at @ExpressMoney_.