Fox News host Lara Trump joins Varney & Co. to discuss President Donald Trumps handling of the Epstein files and the assassination attempt at his campaign rally in Butler, Pennsylvania.

JPMorgan Chase handled the processing of more than $1 billion for Jeffrey Epstein over the course of 15 years despite internal concerns about his status as a sex offender and financial activity, according to a new investigative report by the New York Times.

The Times cited internal bank records, sealed deposition transcripts, other court documents and financial data as well as interviews with people who had knowledge of Epstein’s relationship with the firm. JPMorgan has since said that its relationship with Epstein was a mistake and would’ve been discontinued if they believed he was involved in an ongoing sex trafficking ring.

The Times’ report noted four occasions in a five-year period in which compliance concerns were overridden by JPMorgan leaders to allow Epstein to continue to bank with the firm, and added that the bank established accounts for young women at Epstein’s request.

EPSTEIN ESTATE HANDS OVER ‘BIRTHDAY BOOK,’ CONTACT LIST TO HOUSE INVESTIGATORS

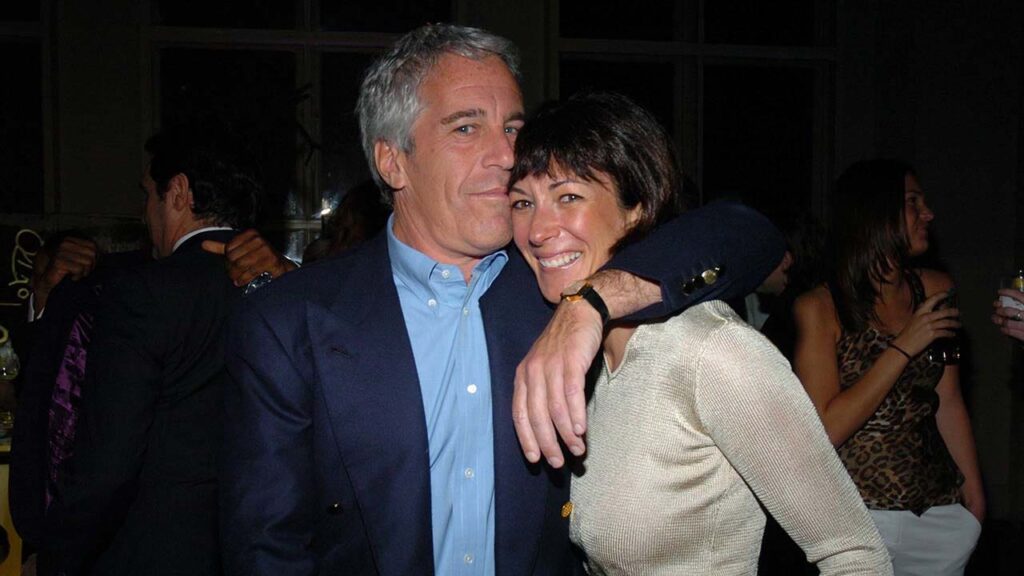

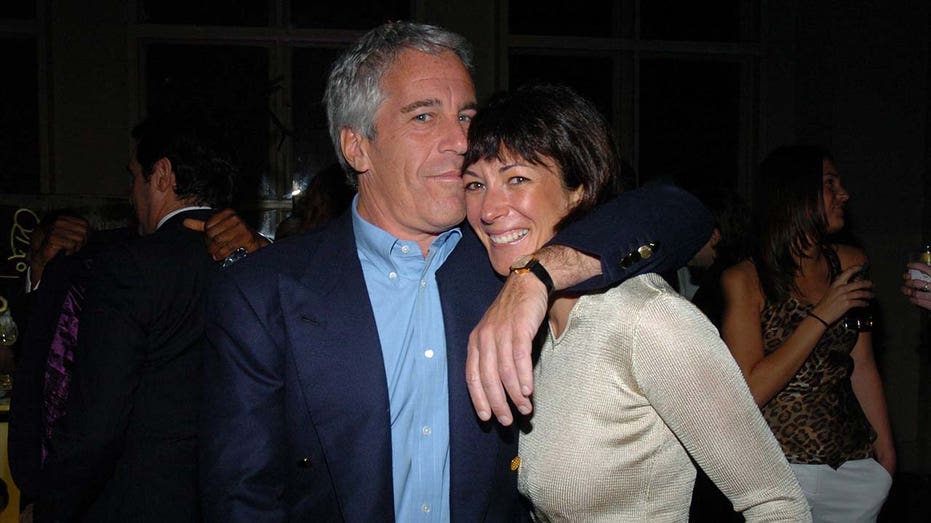

Jeffrey Epstein ran a sex trafficking ring with assistance from Ghislaine Maxwell. (Joe Schildhorn/Patrick McMullan via Getty Images / Getty Images)

Epstein had accounts at JPMorgan worth more than $200 million and played a role in helping the bank land similarly high net worth clients, including Google co-founder Sergei Brin, as well as making introductions to world leaders and helping broker an acquisition for the firm, per the report.

A review by JPMorgan’s compliance division in 2006, the year Epstein was arrested and indicted on sex crimes, flagged concerns with routine withdrawals ranging from $40,0000 to $80,000 multiple times per month, which totaled $750,000 in that year-to-date period. Those transactions totaled nearly $1.75 million in cash withdrawals by the time Epstein pleaded guilty to two counts of felony solicitation of prostitution in 2008, according to court filings.

INSIDE EPSTEIN’S INFAMOUS ‘BIRTHDAY BOOK’: CLINTON’S NOTE, POOLSIDE CANDIDS AND BIZARRE ANIMAL PICS

Signage outside the new JPMorgan Chase & Co. headquarters at 270 Park Ave. in New York, on Aug. 26, 2025. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

Those transactions prompted concerns over money laundering among JPMorgan bankers, and eventually it was revealed that Epstein used accounts at JPMorgan to facilitate money transfers to victims of his sex trafficking ring, according to the Times’ report.

Epstein’s financial activities prompted Stephen Cutler, who was the bank’s general counsel, to privately urge Epstein’s removal as a client of JPMorgan in 2011, a warning that was revealed in portions of a deposition that were made public last year.

BILL CLINTON LETTER IN EPSTEIN ‘BIRTHDAY BOOK’ AMONG NEW FILES RELEASED BY HOUSE OVERSIGHT COMMITTEE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 297.78 | +4.54 | +1.55% |

The Times reported that Cutler weighed taking action to ban Epstein and said in conversations with colleagues that the bank shouldn’t continue to keep a convicted sex offender as a client. However, he said he didn’t see evidence Epstein’s accounts were used in criminal activities and ultimately opted against raising the issue with CEO Jamie Dimon despite his concerns over reputational risk.

Epstein had a prominent backer within the firm in JPMorgan’s head of investment banking, Jes Staley, who pushed back on internal resistance to Epstein’s ongoing relationship with the firm, according to the Times.

Staley later became CEO of Barclays and stepped down from the role amid an investigation into his ties to Epstein. (Jim Spellman/Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Staley left JPMorgan in 2013, the same year that the bank stopped doing business with Epstein, though personnel at the firm continued to hold meetings with him in the following months, the Times reported, citing internal bank calendars and sources.