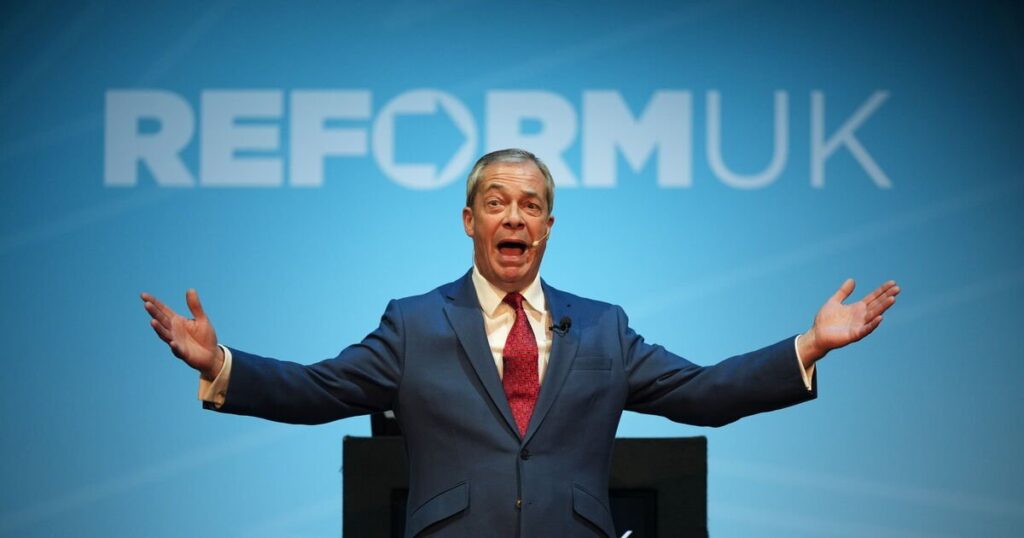

The future of the state pension triple locks remains “open for debate”, according to Nigel Farage. It comes after Reform UK’s new treasury spokesman, Robert Jenrick, hinted that the party would keep the triple lock if it won the next election.

Under the current triple lock policy, the state pension rises every year by whichever is highest out of average earnings growth, inflation, or 2.5%. Mr Farage, the leader of Reform UK, was asked by journalists whether the policy would be included in his party’s election manifesto. He said it remains “open for debate”, adding that he hasn’t changed his mind over the policy as “everything is open for debate”.

Mr Jenrick said at a press conference outlining Reform UK’s fiscal vision: “I’ve always been a supporter of the triple lock. It’s incredibly important to provide dignity and security to older people on fixed incomes in the last decades of their life, particularly at a time like this where there’s such challenging circumstances with the cost of living.

“It’s incredibly important that we provide dignity and security to older people on fixed incomes in the last decades of their life – particularly at a time like this, where there are such challenging circumstances with the cost of living. So I don’t think your readers will be disappointed, but we’ll say more in the coming weeks.”

Reform UK has refused to commit to the triple lock if they win power. Mr Farage previously hinted that the economy may not be strong enough to support the policy.

Ensure our latest politics headlines always appear at the top of your Google Search by making us a Preferred Source. Click here to activate or add us as a Preferred Source in your Google search settings.

A recent report from the Office for Budget Responsibility (OBR) projected that the triple lock will cost the government £10 billion a year more than expected by the end of the decade. Pension benefit spending currently makes up a significant amount of the Department for Work and Pensions’ (DWP) outgoing costs.

Catherine Foot, the director at the Standard Life Centre for the Future of Retirement, said: “In all but its least optimistic life expectancy scenarios, the OBR projects significant increases in public spending.

“A sizeable portion of this increase will be driven by more people receiving the State Pension for longer, as well as the triple lock driving up the state pension amount people receive. At the same time, rates of individual retirement saving are falling far behind what our longer lifespans now require.

She also urged the government to “set out a roadmap to improving retirement adequacy.” The expert said the UK could be on track to face a “retirement crisis” by 2040 if current trends remain.