‘The Digital Chamber’ founder and CEO Perianne Boring weighs in on Donald Trump’s plan to further integrate crypto into the U.S. economy.

Exclusive: The legal woes are piling up for Wall Street’s top cop.

On Thursday afternoon, 18 states filed to sue the Securities and Exchange Commission and its five commissioners accusing them of unconstitutional overreach and unfair persecution of the $3 trillion cryptocurrency industry under the leadership of agency chief Gary Gensler, FOX Business has learned.

Led by Kentucky Attorney General Russell Coleman, the lawsuit was jointly filed in a Kentucky district court in partnership with 17 other Republican attorneys general from Nebraska, Tennessee, West Virginia, Iowa, Texas, Mississippi, Montana, Arkansas, Ohio, Kansas, Missouri, Indiana, Utah, Louisiana, South Carolina, Oklahoma and Florida.

The complaint was filed in collaboration with crypto advocacy group DeFi Education Fund, which advocates for sound policy in the decentralized finance space.

SEC Chairman Gary Gensler participates in a meeting of the Financial Stability Oversight Council at the U.S. Treasury on July 28, 2023 in Washington, D.C. (Kevin Dietsch/Getty Images / Getty Images)

Notably, the lawsuit alleges that the agency’s industry-wide crackdown on U.S. crypto companies is unconstitutional because it violates fundamental principles of federalism, which ensure that government agencies operate within their constitutionally defined roles.

Gensler, in his capacity as chair, has said that the majority of cryptocurrencies, aside from bitcoin and ether, are securities and fall under the SEC’s purview. His position, which the states argue is a broad interpretation of securities law, has resulted in the agency’s enforcement division bringing a myriad of lawsuits against major industry players like exchanges Coinbase and Kraken, blockchain payments firm Ripple, and software tech company Consensys, among many others, for allegedly violating securities law by selling unregistered securities on their platforms.

This assertion by Gensler has been met with fervent pushback from the industry, its legal advocates, including the 18 state AGs, as well as many members of Congress who believe he’s extending the agency’s reach far beyond the bounds Congress intended. Given the lack of clear rules and an ordained regulating body, crypto participants have been operating in what the AGs describe as « regulatory limbo. »

The SEC did not respond to a request for comment.

Gensler defended his actions against the industry during a speech at the Practicing Law Institute’s 56th Annual Institute on Securities Regulation conference on Thursday.

« Court after court has agreed with our actions to protect investors and rejected all arguments that the SEC cannot enforce the law when securities are being offered—whatever their form, » he said.

The seal of the U.S. Securities and Exchange Commission (SEC) is seen at their headquarters in Washington, D.C., U.S., May 12, 2021. (REUTERS/Andrew Kelly/File Photo / Reuters)

The lawsuit further alleges that by imposing penalties and restrictions on digital asset platforms without a proper regulatory framework, the SEC’s actions have introduced « significant risks » to one of America’s fastest-growing economic sectors and infringed on states’ rights to regulate their own economies. The AGs note that Congress intentionally refrained from granting broad regulatory authority over digital assets to federal agencies like the SEC, instead allowing states to lead on the issue, but the SEC has ignored this allocation of power.

« At bottom, the SEC’s regulatory overreach defies basic principles of federalism and separation of powers… the SEC’s assertion of sweeping jurisdiction without congressional authorization deprives States of their proper sovereign role and chills the development of innovative regulatory frameworks for the digital asset industry, » the filing states.

« Still worse, by attempting to shoehorn digital assets into ill-fitting federal securities laws and inapt disclosure regimes, the SEC is harming the very citizens it purports to protect, by displacing better-suited state laws that have been carefully designed to ensure consumer protection in the digital asset industry. »

The SEC’s actions, the AGs claim, amount to a full-scale assault on the U.S. crypto industry.

The headquarters of the Securities and Exchange Commission is seen in Washington, D.C., on Jan. 28, 2021. (SAUL LOEB/AFP via Getty Images / Getty Images)

« It is unfortunate that it came to this point, but I’m glad to see states—including Tennessee—taking a stand against Gary Gensler’s anti-crypto agenda, » Republican Tennessee Sen. Bill Hagerty said in a post on X.

The agency’s perceived unfair treatment of the crypto sector sparked a nationwide industry campaign to make its demands for fair treatment heard in the presidential election. Its wish was granted when now-president-elect Donald Trump embraced the millions of unsatisfied crypto voters looking for a champion, vowing to prop up the industry and end what he called the Biden Administration’s « war on crypto. »

Trump received over $20 million in industry donations while on the campaign trail.

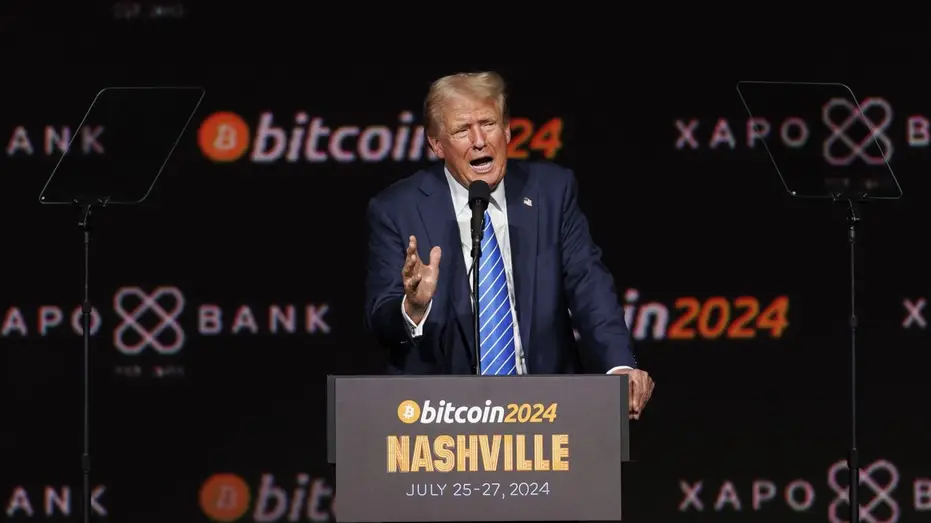

Former US President Donald Trump speaks at the Bitcoin 2024 conference in Nashville, Tennessee, US, on Saturday, July 27, 2024. Trump said he would ask the government to create a massive reserve of Bitcoin if he returns to the White House in a bid to (Photographer: Brett Carlsen/Bloomberg via Getty Images / Getty Images)

Between Trump’s re-election and the Republicans winning the majority in the House and Senate, the $3 trillion crypto business will likely have an easier time when it comes to regulation, thanks to the president and his party.

« Last week, the American people went to the polls and soundly rejected the weaponization of the federal government, » Kentucky Attorney General Russell Coleman said in a statement to FOX Business. « The Biden-Harris Administration’s unlawful crypto crackdown has targeted the tens of millions of ordinary people who are taking part in this vibrant digital market. Along with conservative AGs across the country, we’re filing this challenge to cut the bureaucracy down to size. »

It’s unclear how the lawsuit will progress now that leadership at the SEC is subject to change under the new administration. In his speech at the Practicing Law Institute, Gensler appeared reflective on his time at the SEC, leading to speculation that he may soon step down ahead of Trump’s inauguration in January. The other four commissioners, who were also named in the lawsuit, may choose to stay at the agency until their terms expire.